Social Security is a lifeline for millions of Americans, providing financial support for retirees, disabled individuals, and survivors. As we move into 2025, a new legislative proposal—the Social Security Payment Fairness Act—is making waves. This bill aims to address key concerns about benefit fairness, cost-of-living adjustments (COLAs), and long-term program sustainability.

In this article, we’ll break down everything you need to know about the Social Security Payment Fairness Act 2025, its impact on different groups, and what you can do to prepare for potential changes.

What Is the Social Security Payment Fairness Act 2025?

The Social Security Payment Fairness Act 2025 is a proposed bill designed to make Social Security payments more equitable and sustainable. It focuses on improving benefit distribution, modifying COLAs, and ensuring fairness across income brackets.

Key Provisions of the Bill

- Adjusted COLA Calculations

- The bill proposes a revised method for calculating COLAs, ensuring they better reflect the actual cost increases experienced by seniors.

- Uses the Consumer Price Index for the Elderly (CPI-E) instead of the traditional CPI-W to determine COLA increases.

- Higher Benefits for Low-Income Retirees

- Aims to provide more financial relief to lower-income beneficiaries by increasing their monthly payments.

- Caps on High-Income Benefits

- Wealthier beneficiaries may see slight adjustments in their benefit growth to help balance the Social Security Trust Fund.

- Tax Adjustments for Social Security Contributions

- Proposes raising the income cap on payroll taxes to ensure high earners contribute more to the system.

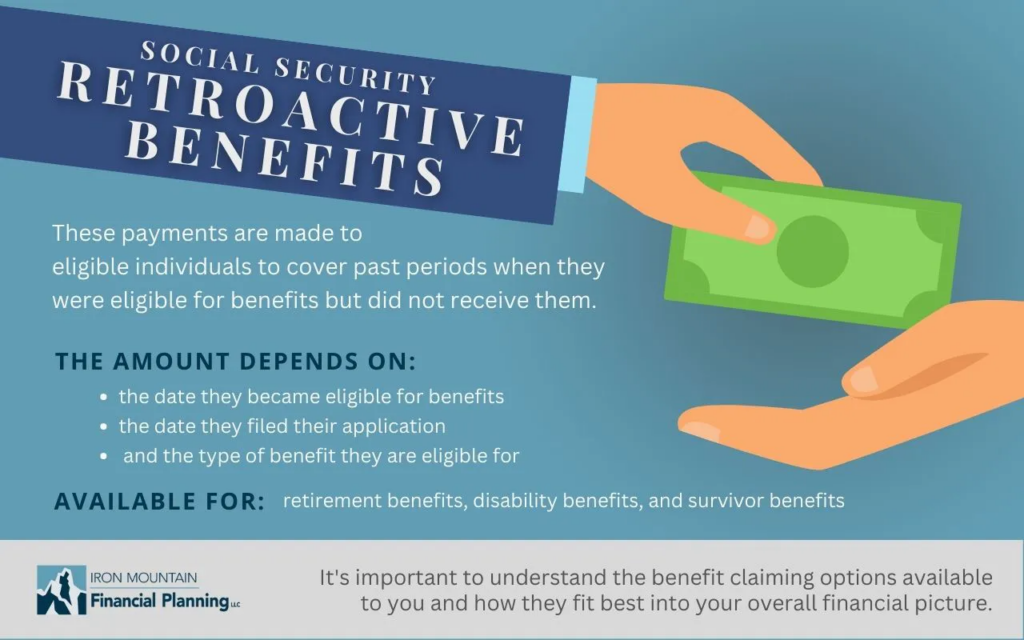

- Survivor and Disability Benefit Enhancements

- Expands benefits for widows, widowers, and disabled individuals to provide better financial security.

How Will This Affect Different Groups?

Retirees

If you’re currently receiving Social Security benefits, this bill could mean larger cost-of-living adjustments, particularly if you have a lower income. The shift to CPI-E would result in higher annual increases that better reflect inflation affecting seniors.

Future Retirees

Younger workers may need to adjust their retirement planning as higher earners could see changes in their benefit calculations. On the positive side, low and middle-income earners stand to gain from improved benefit structures.

Disabled Individuals

Social Security Disability Insurance (SSDI) recipients could benefit from increased monthly payments and easier qualification standards.

Survivors

Widows, widowers, and children of deceased workers may see improved survivor benefits, reducing financial hardship after the loss of a family member.

Why Is This Change Necessary?

The Social Security Trust Fund is projected to face depletion by 2034 if no changes are made. This bill aims to create long-term solvency while addressing fairness concerns in benefit distribution. With inflation rising, many seniors struggle to keep up with the cost of living, making these adjustments crucial.

Public Opinion and Political Debate

The Social Security Payment Fairness Act 2025 has sparked widespread debate:

- Supporters argue it ensures benefits keep pace with real-life expenses and addresses income inequality.

- Critics worry that tax increases on high earners might discourage economic growth.

What You Can Do to Prepare

- Stay Informed – Follow updates from official sources like the Social Security Administration (SSA) and government announcements.

- Review Your Retirement Plan – Adjust your savings strategy based on potential changes in Social Security benefits.

- Advocate for Your Interests – Contact your representatives to share your thoughts on the bill.

Final Thoughts

The Social Security Payment Fairness Act 2025 aims to bring much-needed reforms to the program, making it more equitable and financially sustainable. While some will see increased benefits, others may face tax adjustments. Staying informed and planning accordingly will help you navigate these changes.

What’s Next?

Lawmakers will continue debating the bill, and its final form may differ from its current proposal. Keep an eye on legislative updates and prepare for potential changes to your Social Security benefits.